Ibank Review: Personal Finance Software For Mac

With Mac OS X 10.7 Lion now shipping, I am in process of upgrading. But I am one of those poor unfortunate souls that use Quicken for Mac. It came with some of my Mac's way back so I started using it. I'm not particularly fond of it, but it generally worked, Inertia speaks. But as many of you know, Intuit failed to update Quicken and has relied on Rosetta which no longer ships on Lion. A large part of my Quicken usage is to track investments so Quicken Financial Life or Essentials is not an option for me. I am also still too paranoid/resistant to online services that track everything in one place, so I don't use those.

In a nutshell, I have started looking for a replacement. My requirements mostly center around finance and investment tracking. I don't really need budget planning features. I ruled out Moneydance which I have read many good things about, mostly because I generally dislike using cross-platform Java UIs.

Also, I am concerned about how hard it will be to run Java on Mac in the future. After reading a lot of reviews and opinions, it seemed that only iBank 4 met my criteria.

IBank 4 seems to have hit critical mass and seems to be the most popular of the Mac personal finance software programs. I just downloaded the free trial, and it seems to meet most of my requirements. But there was one feature that really irked me. Their Direct Connect feature which automatically contacts your financial institution and syncs account data does not work with The Vanguard Group. According to iBank's forums (apparently, there are already users already complaining about this), this is because Vanguard uses OFX 2 (an open standard for financial data exchange) instead of an older OFX 1.1. IBank has not updated their software to support OFX 2 and they seem resistant to the idea, with suggestions that it is not worth their time since Vanguard is the only institution using it. Never mind the fact that Vanguard is now the largest mutual fund company.

Also, dragging their feet on supporting a newer version of an open standard strikes me as reminiscent of Intuit not updating Quicken to get off of Rosettathis is the mentality I am trying to flee. Other than the Vanguard issue, the iBank seemed really nice. The user interface is polished, my data imported without serious incident, and there seemed to be a lot of interesting features. I also really liked their forums because I was able to find a lot of information about the specifics of the product, from what it can and can't do, to how to actually do stuff. Originally, the lack of Vanguard support wasn't necessarily a deal breaker for me, but then I realized that working around the issue would cause me to do a lot of work. I tried the web download feature and discovered that because I have more than several funds in Vanguard that generate frequent events, using this feature would create more work for me than doing manual entry.

I started to realize the lack of Vanguard support was actually quite devastating for me. So being on the brink of purchasing iBank 4, I continued my search for alternative software. I discovered a relative newcomer called SEE Finance. They are still not at version 1.0, but the software is very impressive. It imported all my Quicken data without problems and also seems to support most of my requirements. And unlike iBank 4, it does support Vanguard.

And it is half the price ($30) of iBank 4 ($60). This is not to say SEE Finance is perfect.

While at half the price of iBank 4, the user interface lacks some of the refinements and aesthetics of iBank 4. For example, you cannot edit a register directly in SEE Finance and must edit in a separate UI at the bottom of the splitview. Another example is transfers among accounts in SEE Finance must use a special menu option so both accounts are correlated and if you later change the amount in one account, you must manually remember to change the other. Another minor example is both programs allow attachments to be connected to transactions, but iBank 4 has UI to allow you to activate the iSight to take a picture of something or launch the attachment in the default app (e.g.

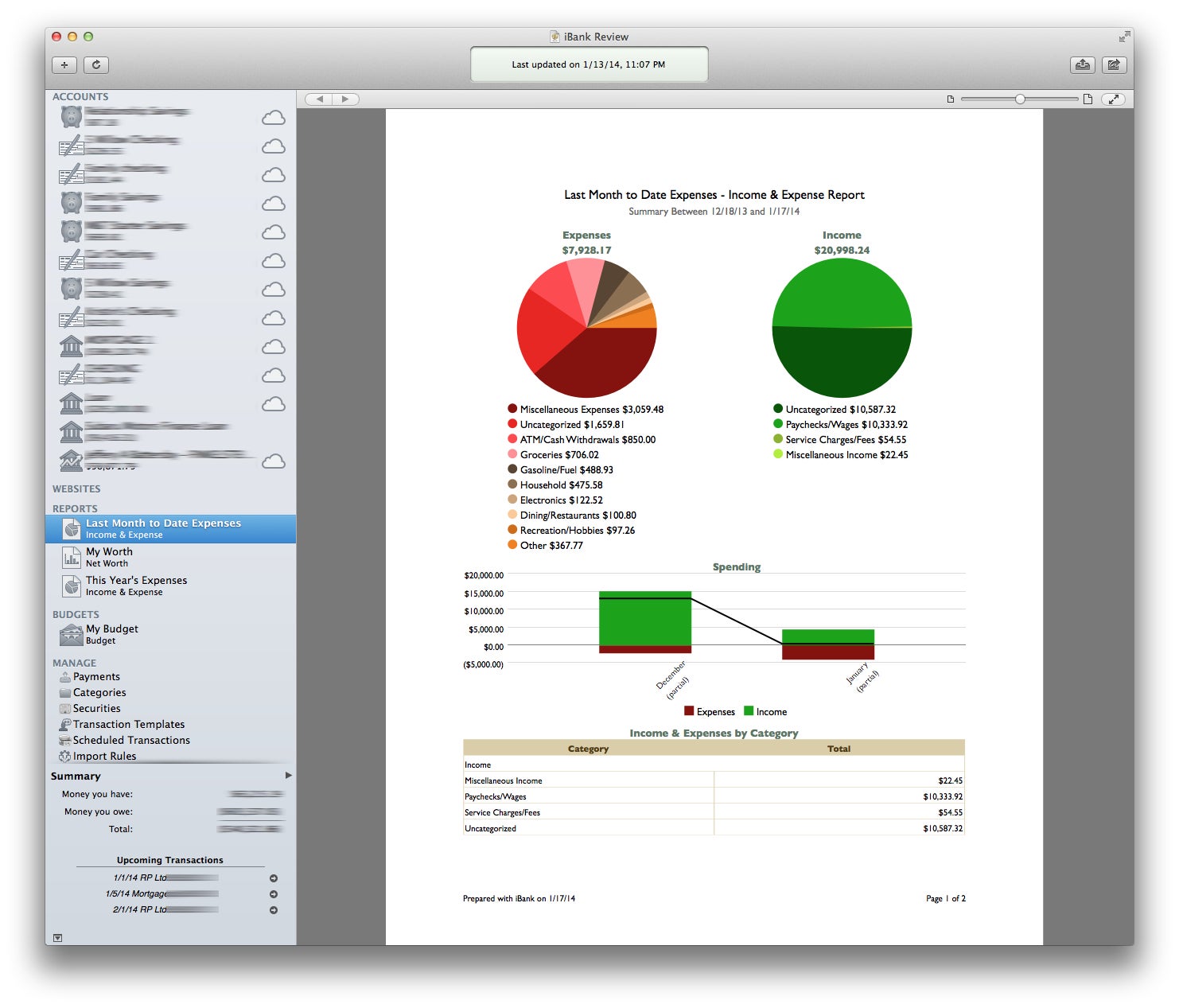

A PDF in Preview.app). Also, the report generation seems very limited or non-existent in SEE Finance. I didn't play with it much in iBank 4 either and the forums implied that iBank 4 itself was still lacking compared to Quicken.

SEE Finance seems to be even more primitive than iBank 4 in this regard. I probably can live without these refinements for now, but these are the trade offs I must decide between.

But right now, I think the Vanguard synchronization is far more important to me. And the developers behind SEE Finance give a strong impression that they know how to prioritize features. Considering how young the product is, but how well it picked the feature set they would support first leaves a good impression. Time will tell whether this impression is correct.

IBank 4 is available through the Mac App Store, retail box, or other online distribution channels. SEE Finance is not currently available on the Mac App Store and is only available online through them and uses registration keys. I was unclear what their license terms because they describe both 'single user' and multi-user.

In addition to the lack of reg keys, another thing I like about the Mac App Store is that the terms allow you to use the software on multiple computers you own. I do most of my work on a desktop, but occasionally want to do stuff on the road on my laptop. Mac App Store (which iBank is available through) terms work for me. I contacted SEE Finance and learned they are only selling 'multi-user' licenses which covers my case. I still have to deal with reg keys, but they said users will get a free upgrade to 1.0 and there will be a Mac App Store version in a couple of months. Anyway, I have 28 more days left in my iBank 4 trial.

I may not wait that long to make a decision/purchase, but I am interested to hear what other people's opinions are. Update (2011-09-05): I purchased SEE Finance.

Over the last 6 years, has continued to lengthen their lead in the Macintosh Personal Finance space, becoming the dominant player assisting you with all aspects of your Financial Life (ironically, that’s what the aborted attempt at was supposed to be called). Unfortunately, as I predicted, Intuit has only made one improvement to Quicken Essentials for Mac since I 4 years ago: you can now export to TurboTax (wow). But I digress, this article is about iBank 5, the new offering from IGG Software in the line.

A piece of software I’ve been running (and loving) since 2011. The Updates Several new features in iBank 5 will have Macintosh finance aficionados jumping up and down and clapping their hands:.

Bill Pay – You heard it, you finally have that long-lost feature back in your Personal Finance software, thanks to IGG Software you will now be able to connect directly to your bank for bill payment. One-button Updating – A new “Update Everything” button for handling all of your account downloads, device synchronization, and investment updates. The goal with this feature is to allow you to significantly minimize the number of manual transactions you enter (I won’t be using it for that reason, but more on that later).

– This is a feature that IGG Software introduced in their iBank for iPad application last year, it is a subscription service ($4.99 per month, or $39.99 per year) that links to your online financial accounts and makes all transactions (even pending ones) available in your iBank applications. Once only available on the iBank for iPad, this update brings it to your desktop. Better Budgeting – The budgeting feature in iBank (something I don’t use much, but may now) has been improved dramatically by automatically incorporating Scheduled Transactions (which I use a lot) into your Budget. Budgets will also now auto-update based on changes and will synchronize to iBank for iPad 2. Budgets were probably the weakest area of iBank previously. Existing users of iBank 4 will be able to upgrade in-app or at the for $29.99. You just download iBank 5 and follow instructions for “Secure purchase”.

So, with a available for iBank 5, let’s peel back the covers and see how it looks. Installation You can from the IGG Software website. In my I complained that IGG Software didn’t provide a link to your Applications folder in the disk image, now they do. Installation is now a simple drag-and-drop onto the provided Applications folder link and you’re done.

Initial Launch Upon first launch of iBank 5 you’re presented with a licensing screen, I clicked Use Trial and began my 30-day Demo. Once past the licensing screen, you are presented with the Welcome to iBank 5 screen where you can choose to Start Fresh (create a new data file), Import from iBank (prior version import), or Import from Other Software (we know who “Other” is). I chose to Import from iBank as I’m already a customer. However, before doing this I backed up my 41MB iBank 4 data file to ensure I wouldn’t have issues should something not work in the Demo. The Upgrade I’ve been an iBank user since 2011 when I.

I have a VERY large data file with tens of thousands of transactions dating back to 1995 and over 80 different accounts. I had a nightmare moving from Quicken to iBank due to the complexity and number of transactions I have. Upgrading to iBank 5 was easy!

The import screen asked me to Chose a File to Import, which I didn’t expect. Why doesn’t it know where my iBank 4 data file is? Or, why couldn’t it just quickly scan and find it? This seemed a bit onerous. Nevertheless, I selected Choose File and pointed it at my current file.

You are then presented a screen to Save Your Data. At this point, I know what’s going on. The file formats between iBank 4 and iBank 5 have changed. IBank 5 is going to actually import and convert the data to the new format. The import process took approximately 2 minutes for my data file and then I was presented with a status screen.

The status screen was titled We fixed your database (I didn’t know it was broken) and amounted to notifying me of a missing password for an online account, and some of my investment transactions which were missing “distribution types” and were changed to “cash”. You are also asked to give iBank 5 access to your Reminders, Calendar, and Contacts, at this point, which I granted. More on this later as well. I was then presented a Congratulations screen and got to see the new interface for the first time. Upon initially looking around, I found a couple of anomalies. The first was that there was an error message being displayed, stating that “This document needs updating”. I tried saving my file, no change.

I tried quitting and restarting and was then told iBank 5 wanted access to my Keychain to gain access to my synchronization server credentials. I granted the access and then clicked the Update Everything button (looks like a Refresh button in the toolbar). That seemed to clear the error. The second, and this is probably just a “Rob Thing”, was that my Registers were all sorted in descending order (the newest transaction is at the top, the oldest at the bottom), I prefer ascending order and keep all my older transactions at the top, with the newest at the bottom. This also led me to check something else I had hoped would be addressed: was there a blank, new, transaction waiting for me at the bottom? You still have to ⌘N. (.command-N) to get a new transaction.

The good news is that if you do it accidentally, you can now click Cancel and it will be deleted (you don’t have to delete it manually like in version 4). So, a nice set of improvements. Interface Changes The interface is completely redesigned, without looking totally unfamiliar. Here is a list of the changes:. Toolbar: MUCH cleaner than previous versions, evenminimalist. By default there are only 4 buttons ( Add, Update Everything, Pay Online, and Post), and only a Calculator available to add.

Gone are Add Report, Add Budget, Download, Web Download, Download Quotes, Sync Devices, Confirm Scheduled and Search. Clearly the Update Everything feature removed 4 of these by itself. The others re-appear elsewhere in the UI.

Transaction Bar: I’m not sure of its official title, this is what I’m calling it. The first pair of buttons provide Adding and Removing transactions. The next set of three buttons provide different views of your Register: Regular (shows all transactions), Resolve (view “New”, “Matched”, and “Uncleared” together to assist in reviewing downloaded transactions), and Reconcile (same as old Reconcile view). Transaction Filter Bar: Again, probably not “Official”, but what I’m calling it. Select from All (yep, all transactions) or filter by Month / Quarter / Year or Uncleared / Cleared / Reconciled.

Register: No change. Accounts Pane: Not much has changed. Gone are the colored icons (though the icons themselves are the same).

Indicators of online accounts now show a “Cloud”. The Regular, Resolve, and Reconcile view buttons are nice. Selecting Resolve allows you to quickly see older, unreconciled transactions in your Register. I usually only notice these when I’m performing an account reconciliation, so this is an easy way to find those at any time.

I mentioned earlier that I wouldn’t be using the Update Everything to manage my transaction downloads. This is mainly because I use iBank to verify what my bank is telling me, so I manually enter all of my transactions myself. That way when I reconcile my accounts, I’m performing an actual reconcile. If you always download from your provider and then reconcile your statements to what they’ve already provided you, guess whatthey always reconcile.

I learned to reconcile my checking account as a kid and it’s always stuck with me, so I’ve always entered my transactions myself. However, if I was a “fully automated” financial person, I would certainly be trying out IGG Software’s.Direct Access.to perform that automation, especially now that it shows Pending transactions as well.

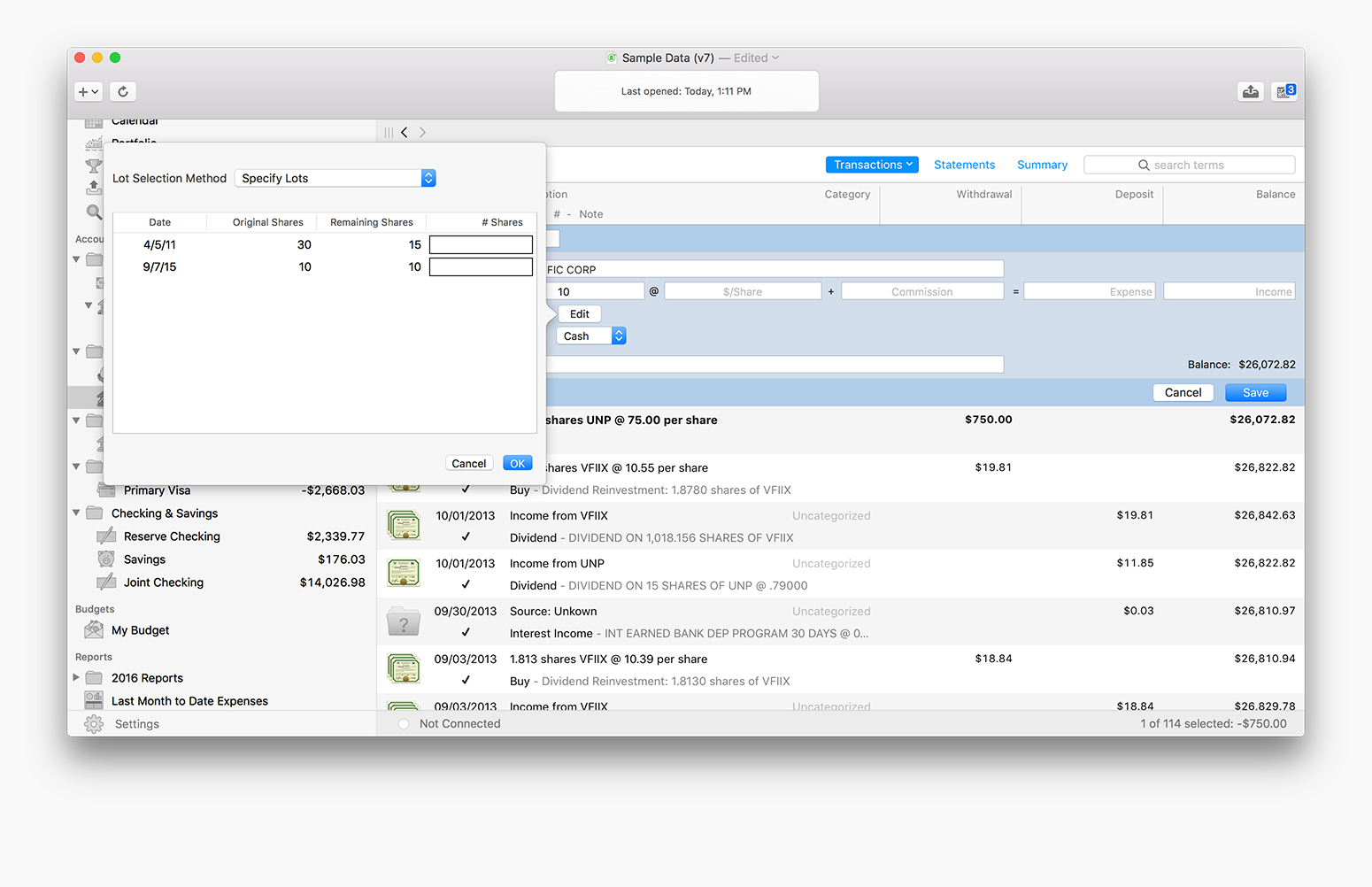

The transaction filters are also a nice addition and I’m finding that I keep mine on Quarter to cut down on the volume of transactions iBank has to manage. This also speeds it up considerably. Unfortunately, it also removes future dated transactions, even if they will be happening in the current quarter (it’d be nice to see them). IBank 5 Impressions I took iBank 5 through some of my normal financial workflows to see how this version compared to the older one. Entering Transactions Entering transactions works the same as it did in iBank 4. There is a small improvement in the speed as you’re moving from field to field.

My biggest complaint in iBank 4 is that the auto-complete was terribly slow as you’re trying to type in a Payee, iBank 5 isn’t a lot better (some, not much). I did have some issues with cutting and pasting transactions between accounts. This has always beenfinicky, but iBank 5 is more so. I found I would have to switch to another account and back again, before I could get transactions to be able to cut (or copy). The Edit menu always seemed to be stuck on “Undo Paste” from my prior paste operation. Reconcile Account The first thing I notice is that the “Checkbox” for reconciling a transaction has been moved to the right of the transaction (from the left). At first, I didn’t think I would like it, but then as I used it the utility of the change became apparent.

By having the checkbox near the amount, you don’t need to have as much of the iBank screen up to quickly reconcile against a digital statement (as all of mine are thanks to and my. I have to talk about speed again here.

Every time I check a transaction as reconciled, I see iBank 5 write to disk, and there is a noticeable lag while that happens. You’ll actually see the application freeze. Try it, check off a transaction and try to scroll at the same time, won’t work. It’s aggravating! Budgeting I didn’t use budgeting in iBank 3 (or 4). I decided to give it another try with iBank 5.

I created a new budget and it prompted me to identify the Accounts I was going to use (or keep with all) and the Categories I was going to use (or keep with all). It then looked through my Scheduled Transactions and found both of my household’s paychecks (my wife and I) as income. The next step again went through all of my Scheduled Transactions and found expenses. I noticed one of the expenses was wrong, so I clicked the Edit button provided, only to receive an error telling me I could not edit the transaction template from there. If you’re going to give me an Edit button, don’t give me an error.

So, you will need to make sure all of your Scheduled Transactions are correct before going into the Budget process, otherwise, you have to abandon the setup and go correct them. You will then be prompted to Set up Envelopes if you’re interested in. All of your “Envelopes” will then be presented with the starting cash that should be in each one of them. The Budget will then be created. The envelopes will be exposed under each Category you originally setup an envelope for, and transactions will be credited or debited from the envelope, giving you an electronic view of each of your physical envelopes. You can then move forward and backwards through the months to see how you’ve been doing on your budget, and what to expect coming up. I’m definitely going to explore this more in depth and see if I can adapt it for my personal use.

The only strange behavior I saw was that since I have our Paychecks defined with all of the deductions, those become budget categories. I’ll need to tune the budget, as seeing Payroll Taxes being my largest budgeted expense is just depressing. Issues Encountered There are a few problems in iBank 5. They’re relatively minor and shouldn’t dissuade you from using the software, but you should be aware of them. Sync Errors: Fixed in iBank 5.01 – I’m currently getting an error during synchronization of my devices (my iPhone, my wife’s iPhone, and my iPad): Hopefully this will be addressed in a future update.

Might be related to the fact that I’m using a private WebDAV server as the synchronization point. Online Bill Pay: I tried to setup PNC Bank Virtual Wallet, but it doesn’t appear compatible. Not surprising (lots of services don’t support it), but a bummer nonetheless:. Reminders, Contacts, and Calendars: This is a real issue. During the initial setup you’re prompted by the Operating System to allow access.

It would be MUCH better if IGG Software first told you WHY this was happening. What’s worse, is that if you allow the access to all three then following things happen (you can deny access under System Preferences Security & Privacy):. All of your Scheduled Transactions are placed on your Remindersfor every due date (these are stored in an iBank list under On My Mac). You can control this behavior from within iBank 5 under Manage then Scheduled Transactions in the left navigation. There is a small checkbox in the top-right. I’m not actually sure why you’re prompted to provide access to your Contacts and Calendar, I cannot find where they are used. Don’t allow it.

Weird Save Behavior: I’m not sure what else to call this. IBank 5 appears to update the data file every time you do anything in iBank 5. The only reason I notice this is that I have my Documents folder in my Dock and it always shows the most recently updated file. When I’m using iBank 5 I see my data file constantly being updated, it’s kind of annoying. On the other hand, it gives me some solace knowing that all of my changes are being immediately saved in the case of a crash.

Scheduled Transactions: This is a minor issue, but when Posting a scheduled transaction, it doesn’t automatically select the next one. Suggestions for Improvements. on iBank 3 had one “Bad” item: Speed.

I also had issues with performance under iBank 4 as well, it was just plain sluggish depending on what you’re doing. I notice it most whenever I’m searching transactions, the application always “Beach Balls”, but if I just wait, it will eventually finish. I also notice it when entering a new transaction and tabbing between fields, especially when using the auto-complete. IBank 5 is noticeably quicker, but not where I’d like it to be.

This is where IGG Software should be focused in the future with iBank as the sluggishness pervades all of your use of the product. Making transaction entering, searching, and updating faster would vastly improve a newcomer’s impression of the product. “Notify me when an update is available” is not still not selected by default – Make sure you check it off under Preferences.

I’m sure the concept is that if you buy from the App Store, you’ll be notified by Apple; so my suggestion to IGG Software is to just leave that option out of the App Store version, but check it by default on the download version. Make Transaction entry faster. This is what people are doing with the application, it needs to be very responsive. Fix the caching to disk on every change. I shouldn’t notice the updates you’re making in the User Interface, and right now I do. Please give us a “Sync Devices” button for the Toolbar.

I don’t want to “Update Everything” all of the time, the choice is already under the File menu, just expose it as a button. Adding new transaction should date it with today’s date, always.

Ibank Review: Personal Finance Software For Mac Free

Allow something like a shift-plus to add transactions with a date of the last edited transaction. Create a non-saved, blank transaction, dated today, sitting at the bottom, or top, of the register, to allow for quick entry of a new transaction. When entering a stock, don’t convert the name to the symbol (or make it a preference). Please fix the issue for scheduled transactions not auto-selecting the next one, the more I Post my Scheduled Transactions, the more annoying this gets. The Conclusion Too long, Didn’t Read (tl;dr): iBank 5 is worth the upgrade. There are still some speed / performance issues, but it is an upgrade you don’t want to miss. Updates.

20131015 – Updated article to reflect personal upgrade from iBank 5b4 to iBank 5b6. 20131115 – Corrected article concerning licensing the Beta, you can. Corrected article concerning device sync errors which appear fixed now in Beta 6. 20131130 – Article updated to reflect retail version of iBank 5, all references to Beta removed.