Two-line Display For Quicken For Mac

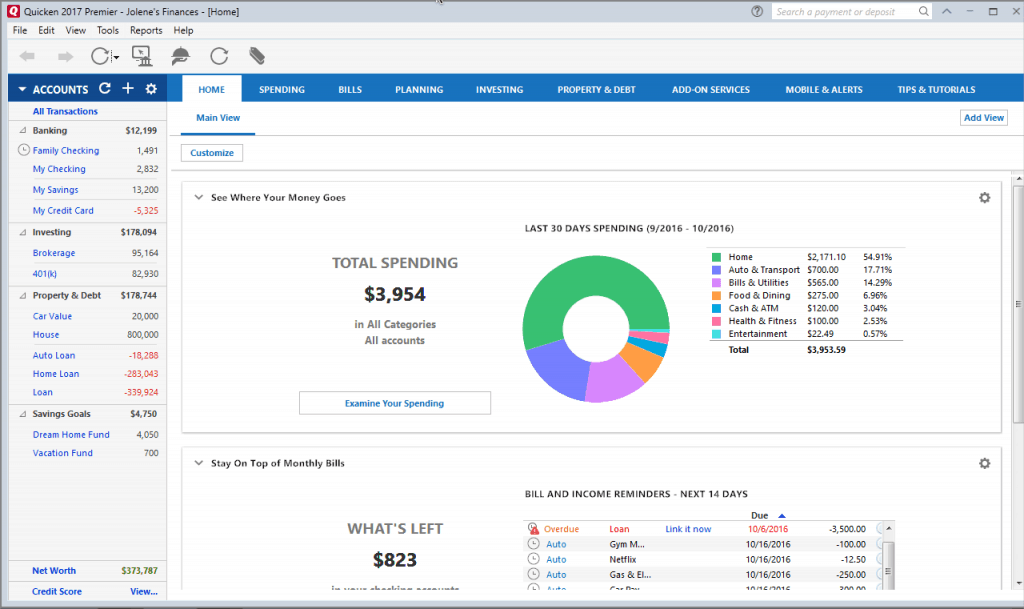

Updated September 16, 2018 When you, you get a transaction register where you can automatically or manually enter actions that affect the balance in your account, such as purchases and payments. You have the option of changing your account register preferences in to better meet your needs. For instance, you may want to automatically place the decimal point in a certain spot, fade out reconciled transactions, show dates before check numbers, or even change the fonts and colors used. Some of the options available for customizing your account preferences in Quicken for Windows 2016, 2017, and 2018 appear below. In order to make any of these changes, choose the Edit menu in Quicken. Next, click Register in the left pane.

You can then make your changes in the right pane and click OK to save those changes. Note: Some of these options don't work for investment accounts, since investment transaction lists don't work the same way as regular account registers.

Two-line Display For Quicken For Mac

Microsoft Word is the undisputed king of text-editing apps on the Mac, and similarly, Quicken is virtually without competition when it comes to personal-finance software. Just as Microsoft has resorted to adding extraneous functions to entice users to upgrade periodically, Intuit has also succumbed to releasing new versions that sometimes contribute more to feature bloat than to significantly enhancing users’ productivity. Intuit claims that Quicken for Mac 2006 contains more than 50 improvements based upon user suggestions, but there are only four major new features—Smart Payee,.Mac backup, greater scheduling flexibility, and simplified downloading of multiple accounts.

Meanwhile, many long-time annoyances remain. Four helpful features Smart Payee, the flagship new feature, offers the ability to batch-rename payees.

For example, if a store name in a downloaded transaction appears in all capital letters followed by a cryptic merchant code, such as “WILLIAMSSONOMA01002369,” you can manually change it to “Williams-Sonoma.” Quicken then applies that change to all past and future transactions from the same payee. Everyone benefits—not just the anal-retentive crowd—because this reduces the total number of payees, resulting in more-accurate reports. Unfortunately, creating Smart Payees works differently when downloading transactions from a financial institution (just retype the name of the payee) than it does when browsing a register (click the arrow icon at the right of the payee field and select from the pop-up menu). And I defy anyone to figure out how to tweak the renaming rules without consulting Quicken’s 445-page PDF documentation. In the wake of Hurricane Katrina, I really appreciate the added ability to automatically back up an encrypted version of my Quicken data file to my iDisk’s Documents folder whenever I close the file (you must subscribe separately to.Mac, of course).

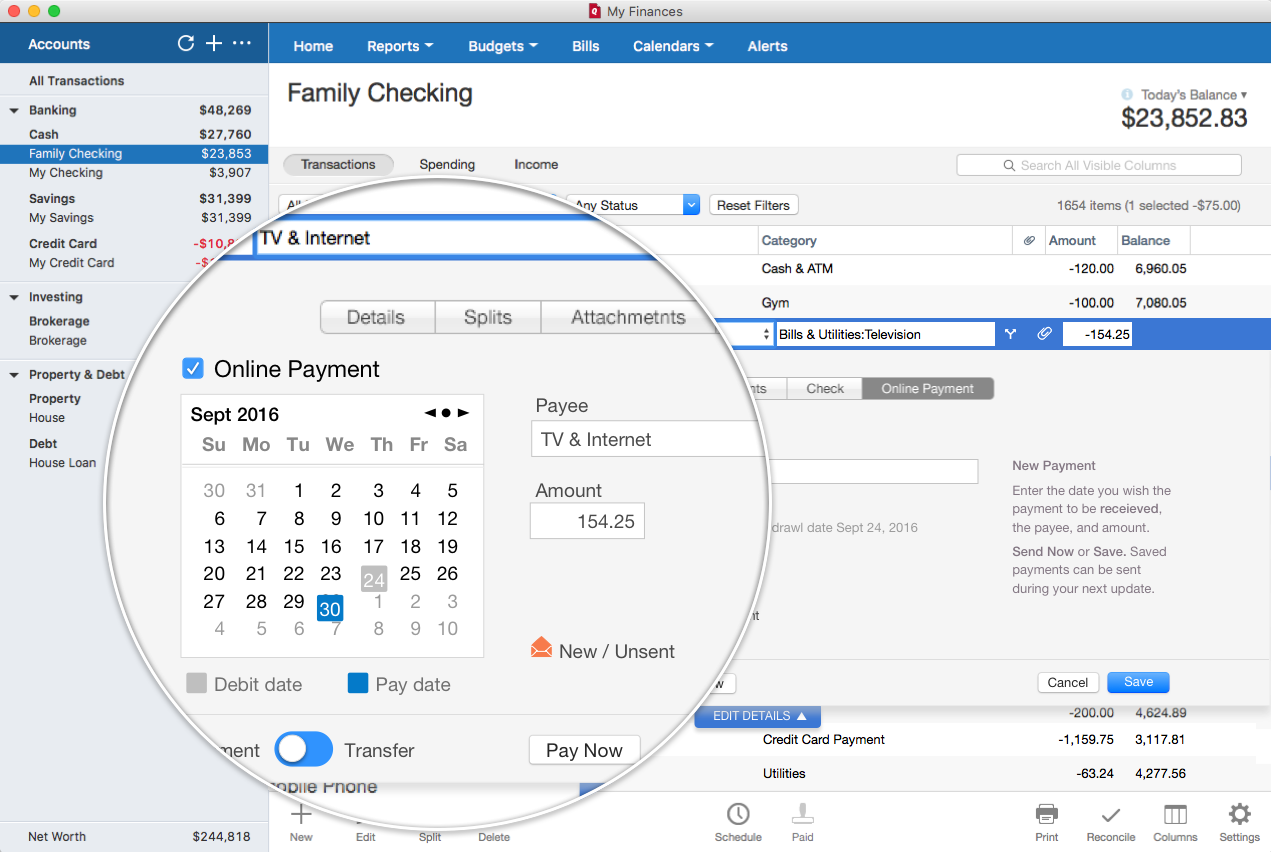

Keeping a current offsite backup couldn’t be easier. In this same vein, Intuit’s data recovery service is now free, no longer $200. The upgrade will pay for itself if you ever need to restore or recover a data file, but employing good backup practices with Mac OS X’s existing tools can accomplish the same thing without having to spring for the new version. Quicken 2006 also features more choices in scheduled transaction frequencies to address common occurrences such as quarterly estimated taxes, biannual property taxes, and Social Security payments that arrive on specific days of each month. If you make heavy use of scheduled transactions, you’ll appreciate how Intuit has revamped this formerly confusing interface to reduce confusion. The last major new feature is the ability to download data for multiple accounts from a single financial institution, such as separate personal and business checking accounts, or two spouses’ credit card transactions.

Downloading all your data in one fell swoop is a definite time-saver, but hardly something to get excited about unless you have lots of accounts. Most of the other improvements are so minor you probably won’t even notice them, and Intuit didn’t bother enumerating them.

For example, a colored line in account registers delineates past and future transactions; the check number field now can display as many as eight digits; there’s support for the Check 21 ANSI format; and you can customize or rename transaction types as needed. Still far from perfect Despite these small improvements, many long-time quirks remain unaddressed, many of which Intuit says are not problems, but are by design. For example, you can’t allocate transactions to hidden accounts without first showing them; balances aren’t displayed when transferring funds between accounts; the Portfolio window lacks annualized rate of return; you must enter splits for every account in which you hold a company’s shares; entering investment actions is tedious because the default account isn’t the last one used; and you still can’t resize many of the dialogs to take advantage of large screens. One exception is my complaint that stock-price graphs don’t accurately reflect splits, which Intuit confirms, saying it is “actively looking at this,” though it has not promised a fix yet. Macworld’s buying advice If you’re still keeping track of your finances with paper registers or Microsoft Excel, Quicken 2006 is a vast improvement and well worth the retail price.

You can’t beat its integration with over 1,800 banks, brokerages, and credit card providers. However, if you’re already using last year’s release, only you can tell if the few new features are compelling enough to justify the $60 investment. is a San Francisco-based freelance writer who has recently written two Apple Training Series books: Desktop and Portable Systems, 2nd Edition (Peachpit Press, 2005) and Mac OS X Support Essentials, 2nd Edition (Peachpit Press, 2005).